Click to enlarge

Robstown ISD Proposed Service Plan

Robstown ISD Proposed Service Plan

On April 26, 2022, Del Mar College received petitions requesting an election on the question of the annexation of the territory encompassing Robstown Independent School District.

Signatures on the petition were verified by DMC on May 9, 2022.

On May 10, 2022, the Del Mar College Board of Regents accepted the petitions and directed College staff to prepare a proposed Service Plan and arrange for a public hearing per Texas Education Code Sec. 130.065.

Information from May 2022 meetingInformation from the June 2022 meetingDMC District Service Plan for Robstown Independent School District

On June 2, 2022, the Regents completed and approved the Service Plan and directed publication of the plan.

-

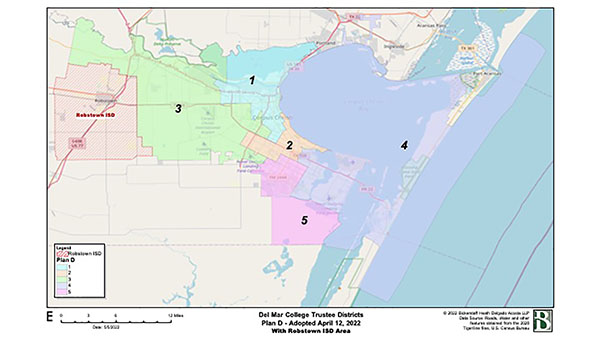

Robstown Independent School District Map

-

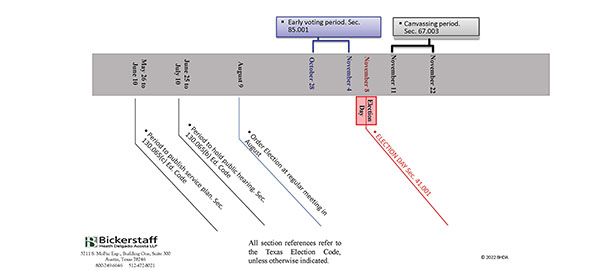

Timeline for Special Annexation Election Process

-

Elements of Proposed Service Plan (Tex. Educ. Code Sec. 130.065)

(c) Not later than the 30th day before the date of a public hearing held under Subsection (b), the board shall complete and publish a service plan for the territory proposed for annexation.

The service plan is informational only and must include:

- the maximum property tax rate that the board may adopt;

- the most recent property tax rate adopted by the board and any tax rate increase proposed or anticipated to occur after the annexation;

- the tuition rate that would apply after annexation for a student who resides in the district;

- the tuition and fees that would apply for a student that resides outside the district;

- plans for providing educational services in the territory, including proposed or contemplated campus and facility expansion in the territory;

- plans for cooperation with local workforce agencies; and

- any other elements consistent with this subchapter prescribed by rule of the Texas Higher Education Coordinating Board.

-

Proposed Service Plan for Robstown ISD

- The maximum tax rate allowed under the Texas Education Code is $1.00 per $100 assessed property valuation. Of this maximum tax rate, no more than $0.50 can be dedicated to paying for debt service on facilities bonds.

- The Maintenance and Operation tax rate for 2022 is $0.196870 per $100 assessed property valuation.

- The debt service rate for 2022 is $0.069234 for a combined tax rate of per $100 assessed property valuation of $0.266104.

- Pursuant to Texas Tax Code, the maintenance and operations tax rate cannot increase taxes collected by more than 8 percent from the prior year without voter approval.

-

Tuition and Fees

- The in-district tuition and fees for the 2022-2023 academic year is $107 per credit hour. In addition, the College charges a flat fee per term of $85.00 for a total of $192.00.

- The out of district tuition is $157.00 per credit hour. In addition, the College charges a flat fee per term of $85.00 for a total $242.00.

Semester Hours District Resident Out of District Out of State/Foreign Difference (District & Out of District) 3 $406 $556 $667 $150 6 $727 $1,027 $1,249 $300 9 $1,048 $1,498 $1,831 $450 12 $1,369 $1,969 $2,413 $600 15 $1,690 $2,440 $2,995 $750 -

Key points of the Service Plan

- Expansion of local delivery of services and programs at the in-district rate,

- Eligibility to vote in DMC Board of Regents elections;

- Access to DMC campuses, centers and amenities,

- Student support services including advising, admissions, academic counseling, career counseling, financial aid, and student life activities at the in-district rate,

- Customized training, Skills for Small Businesses, Texas Workforce Commission Skills Development Fund, and employee training in support of business initiatives,

- Access to degrees and/or certificates in transfer and career pathways, and

- Access to programs such as English-as-a Second Language, Literacy and Adult Basic Education.

- Upskilling and reskilling programs of high value and in demand workforce education and training that can be completed in one year or less.

-

Projected impact on taxes for Robstown ISD Homeowners

Average taxable home value in RISD is $54,084.

Tax impact at the present overall tax rate is an increase of $144 annually or $12.00 per month

Tax exemptions will apply as indicated below:

- Based on the average RISD home value of about $54,084 the average DMC tax bill for a homeowner would be about $12 per month.

- DMC has adopted a Homestead Exemption of $5,000.

- DMC has also adopted a Senior or Disabled Exemption of $50,000 plus the $5,000 regular Homestead Exemption, for a total Homestead Exemption for Seniors or Disabled persons of $55,000.

- DMC has also adopted that each disabled veteran is entitled to the mandatory exemption provided in Section 11.22 of the Code.

Page last updated October 20, 2022.